Sponsored

MGAs build confidence in a complex non-standard risk market

In a roundtable hosted by Geo Underwriting at Broker Expo 2024, industry professionals explored the challenges brokers face in placing non-standard risks. This article examines the key themes that emerged from that discussion.

Underinsurance: how big is the problem and what can brokers do to solve it?

Inaccurate buildings sums insured are one of the biggest causes of claims disputes, creating problems for policyholders, brokers and insurers.

Why the future for brokers is data-driven

The latest Insurance Age Pulse survey explores how brokers are using data insight to guide business strategy, and reveals why more now see data as an essential factor for growth. Rachel Gordon reports

Video Q&A: Open GI director of brokers and MGAs Nick Giddings

In the run-up to Broker Expo on Thursday this week, Open GI director of brokers and MGAs Nick Giddings spoke to Insurance Age content director Jonathan Swift about how software partners can help brokers get to grips with new technologies such as GenAI.

Top 100 UK Insurance Brokers 2024: Q&A with Open GI CEO Simon Badley

Simon Badley, the CEO of Open GI, the sponsor of the UK Top 100 Insurance Brokers 2024, reflects on the changing market, and how his company can help intermediaries navigate opportunities for further growth in the future.

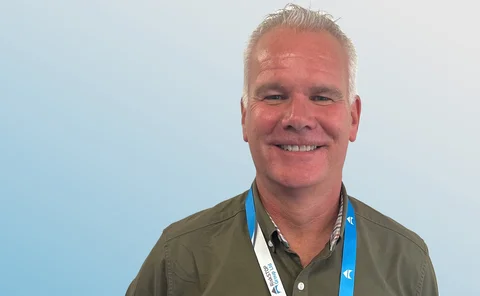

Video Q&A: Bravo Networks development director Kevin Westcott

With Broker Expo just over a week away, Bravo Networks development director Kevin Westcott spoke to Jonathan Swift about why data is such a crucial aspect of embedding the right placement strategy for brokers.

Video Q&A: Geo Underwriting CEO Jaime Swindle

In the run-up to Broker Expo next week, Geo Underwriting CEO Jaime Swindle spoke to Insurance Age content director Jonathan Swift about why the business has a different look and feel today than in the past.

Blog: Questions need to be asked around solar panel fire risks

With reports of the number of solar panel fires rising six-fold in recent years, RiskSTOP’s head of technical risk engineering & surveys, Paul Farmer, suggests insurers and brokers need to start asking questions around maintenance, inspections and more.

Video Q&A: RSA distribution development director Laura Fox

A year on from the NIG acquisition being announced, Laura Fox, distribution development director at RSA spoke to Insurance Age content director Jonathan Swift about the integration process.

Blog: The integration of NIG into RSA – moving towards a unified market presence

A year ago, RSA reached an agreement with Direct Line Group to acquire its brokered commercial lines operations, including NIG and FarmWeb. David Enoch, distribution and proposition director at the insurer, gives an update on the progress since then.

In depth: Staying ahead of cyber risk

Insurance Age has teamed up with Aviva for an In Depth series exploring the latest trends across the rapidly changing cyber threat landscape.

Video Q&A: Close Brothers Premium Finance MD Shaun Hooper

Following a recent survey of commercial brokers, Close Brothers Premium Finance managing director Shaun Hooper dissects the findings and offers insights into what his firm is doing to help intermediary clients avoid underinsurance.

Cost-of-living crisis pushes up premium finance demand

New research has found almost 60% of UK brokers agreed the proportion of commercial lines clients choosing premium finance to pay for their insurance will increase over the next 12 months. Rachel Gordon reports

In Depth: Managing cyber risk in an ever-changing security landscape

In today’s interconnected digital landscape, cyber threats are becoming more sophisticated, posing serious risks to organisations and their partners. Aviva’s cyber senior risk consultant, Oliver Osei-Ofosu, explains the importance of cyber security can…

In Depth: Cyber risk and AI – friend or foe?

The rise of artificial intelligence signals both a threat and opportunity for UK firms in pursuit of a cyber-secure future. But how can brokers help clients stay on the winning side, asks Saxon East.

In Depth: New dimensions in cyber risk

UK businesses are under increasing threat from cyber attack, yet it remains one of the most underinsured risks. Saxon East reports

In Depth: Businesses falling into the justice gap

Widely seen as a personal problem, diminishing access to justice also severely impacts businesses. Tony Buss, managing director at ARAG explains how the justice gap has become a major issue for companies in the UK and what brokers can do to help.

In Depth: LEI as a proactive shield - the role of the insurance broker

The widening access gap in legal systems, exacerbated by chronic underfunding and post-pandemic pressures, presents significant difficulties for individuals and businesses seeking justice and challenges for insurance brokers in effectively serving their…

How can brokers maximise their brand through digital communication and social media messaging

Insurance Age, in association with Aviva, recently published a series of articles looking at how brokers can use digital channels and social media to build their brand and grow their business.

Premium finance brings businesses benefits beyond instalments

A new survey, conducted by Insurance Age and Close Brothers Premium Finance, reveals that while most commercial brokers discuss premium finance with their clients, they do not always highlight other key advantages beyond spreading the cost. Rachel Gordon…

Blog: Digital systems – More a present day necessity than futuristic vision for brokers

Brokers can make a leap in terms of managing client relationships and understanding market dynamics through using digital systems. Stubben Edge director of intermediary Andy Waring looks at what is available and how they can be implemented for maximum…