Emmanuel Kenning

News editor, Insurance Age

Emmanuel is the News editor of Insurance Age and has over a decade of experience writing about the insurance industry.

Well connected with the broking community he is now in his second stint at Insurance Age.

He started his career as a reporter on broker-focused title Professional Broking in 2009 becoming a senior reporter ahead of joining Insurance Age at the end of 2010.

Promoted to features editor in October 2011 Emmanuel became editor the following June holding the post for nearly six years before deciding to return to being a reporter to focus on news writing and analysis.

Along with deep knowledge of insurance he has also gained a solid understanding of reinsurance through a year writing on the market with a particular focus on insurance-linked securities at Trading Risk.

He re-joined Infopro-Digital in late 2019 taking up the position of senior reporter at Post working on the broking beat.

Emmanuel returned to Insurance Age in February 2022 to lead the news team. He focuses on bringing in and editing exclusive news and analyses along with keeping readers up to date on company announcements throughout the sector.

He also supports the editor across videos, podcasts, events, profile interviews, data driven research, opinion pieces and more to help keep Insurance Age ahead of the competition.

Follow Emmanuel

Articles by Emmanuel Kenning

Zurich invests $60m in cyber provider Cowbell

Zurich Insurance Group has invested $60m (£46.65m) in Cowbell, a provider of cyber insurance for SMEs.

Dual eyes up Bristol and Manchester for new regional offices

Dual is targeting Bristol and Manchester for the two regional offices previously promised this year, Insurance Age can reveal.

Charles Manchester: Reflections on a career in insurance

Charles Manchester shares his reflections on the challenges and achievements during his time in the market as well as the outlook for MGAs and opportunities for the sector.

The Broker Investment Group ups stake in Glowsure to 49%

The Broker Investment Group has increased its stake in Droxford-based Glowsure Insurance Brokers to 49%, having first invested in 2017.

UK pricing continues down – Marsh

Insurance rates in the UK fell 3% in the second quarter of 2024, continuing on the downwards trajectory from the previous three months, according to the latest research by Marsh.

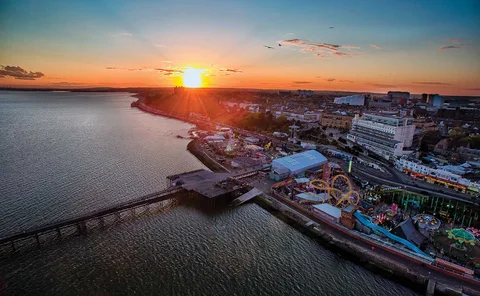

Clear buys book and assets of Maynard Milton Insurance Services

Clear Group has bought the book and assets of £4.9m gross written premium Southend-on-Sea based broker Maynard Milton Insurance Services.

Whistleblowing to FCA slips back

The Financial Conduct Authority received 253 reports from whistleblowers between April and June, down on the same period of last year and the first quarter of 2024.

Acturis continues personal lines push with Covéa

Acturis has partnered with Covéa to make the insurer’s Home IHP product available on its platform, adding to the previously rolled out motor offering.

Voyager Insurance Services sold to Caledon Group

Recently-formed investment group Caledon has bought travel and wedding insurance broker Voyager Insurance Services for an undisclosed sum.

Interview: Tim Smyth, Bspoke

Bspoke Group CEO Tim Smyth tells Insurance Age about reaching profitability and expanding with brokers through organic growth, hires and new products as well as acquisitions.

Clarke starts at WTW as president of risk and broking

WTW has confirmed the arrival of Lucy Clarke as president of risk and broking, with Adam Garrard taking on the new role of chairman of risk and broking.

Next deal on the horizon for Bspoke

Bspoke Group has “signed heads” on its next deal, with an announcement to come ‘in weeks’, CEO Tim Smyth has told Insurance Age.

Partners& snaps up two in employee wellbeing and healthcare push

Partners& has bought Nottingham-based Halo Consulting and Chester-based Personal Healthcare Management.

Ecclesiastical urges insurer climate credentials be part of broker-client conversation

The majority of brokers are not talking to clients about insurers’ climate credentials, according to research from Ecclesiastical, Insurance Age can reveal.

Ageas here for brokers Beckett promises as connected personal lines flourishes

“We are here for the broker today, and we will very much be here for them tomorrow. There’ll be no change in that strategy,” Ageas chief distribution officer Adam Beckett tells Insurance Age.

Former broker brand Kwik Fit resurfaces

UK automotive servicing and repair company Kwik Fit has launched insurance for car owners on its website.

Government starts discount rate review

The Ministry of Justice has confirmed the start of the 2024 review of the personal injury discount rate in England and Wales with a decision due no later than 11 January 2025.

Academy turnover dipped in run-up to Blixt buy

Academy Insurance Services’ turnover and profitability fell in the run-up to being bought by private equity house Blixt, according to a filing at Companies House.

Underinsurance concerns mount as HNW clients cut cover – Ecclesiastical

Follow-up research among brokers by Ecclesiastical has pinpointed growing worries of high-net-worth underinsurance with a quarter of clients having reduced cover during the past year.

EY records worst motor performance since 2011 with 112.8% NCR

The UK motor insurance market experienced its worst performing year since 2011 last year, recording a loss-making net combined ratio of 112.8%, according to EY’s latest UK Motor Insurance Results.

Verlingue maintains profits as turnover ticks up in 2023

Verlingue UK grew turnover by 8% in 2023 to £21.07m as post-tax profits remained stable.

Somerset Bridge swings to Ebitda profit as turnover doubles in 2023

Arch Reinsurance-owned Somerset Bridge Group trimmed post-tax losses in 2023 to £13m from £32m the year before, as it moved into positive Ebitda territory.

Aureum Insurance Brokers launches in Milton Keynes

Aureum Insurance Brokers has launched as a trading name of Momentum, targeting property, construction, motor trade, manufacturing, IT & technology and professional services business.

PIB reveals costs of record 26 deals in 2023

PIB spent £331.9m on a record 26 deals in 2023 as the consolidator expanded in the UK and across Europe.