News

BMS buys DR&P as Inflexion exits

European mid-market private equity house Inflexion has agreed to sell its investment in David Roberts & Partners to BMS Group, having first taken a stake in 2021.

Lycetts grows turnover and operating profit in 2023

Newcastle-headquartered Lycetts grew turnover by 15.8% to £25.1m and operating profits by 20.7% to £3.77m in 2023.

Richard Hodson joins Onda

Former Oval, Gallagher and UKGlobal cyber expert Richard Hodson has joined Onda as UK business development director.

Gallagher holds steady on organic growth in Q2

Gallagher achieved 7% organic revenue growth in its UK and Ireland retail division in the second quarter of 2024, up from 6% in Q1.

Zurich invests $60m in cyber provider Cowbell

Zurich Insurance Group has invested $60m (£46.65m) in Cowbell, a provider of cyber insurance for SMEs.

Allianz updates motor trade product

Allianz has refreshed its motor trade product with the aim of reflecting the evolving needs of its customers and the technological changes that are affecting the sector.

People Moves: 22 – 26 July 2024

Keep up to date with the latest insurance personnel moves.

Cyber outage insured losses estimated at up to $1.5bn

CyberCube has estimated preliminary global insured losses for the standalone cyber insurance market from the CrowdStrike IT outage last week at between $400m (£310m) and $1.5bn (£1.16bn).

Ghost broker sentenced for £17,000 Instagram insurance scam

Wahidullah Usmani, 22, of Prayle Grove, Cricklewood, has been sentenced to 24 months’ imprisonment, suspended for 24 months, for making £17,618 by selling invalid car insurance policies on Instagram.

The Broker Investment Group ups stake in Glowsure to 49%

The Broker Investment Group has increased its stake in Droxford-based Glowsure Insurance Brokers to 49%, having first invested in 2017.

Which? finds 48% of people making claims experience at least one problem

Which? has called on the Financial Conduct Authority to take tough action against firms over claims handling failures, arguing consumers are suffering from “significant harm”.

UK pricing continues down – Marsh

Insurance rates in the UK fell 3% in the second quarter of 2024, continuing on the downwards trajectory from the previous three months, according to the latest research by Marsh.

IFB warns of increasing danger as ghost broking rises 6%

UK insurers reported a 6% rise in ghost broking activity on social media last year, according to the Insurance Fraud Bureau as it warned the threat of people being duped would continue to increase with the growth of financial strain.

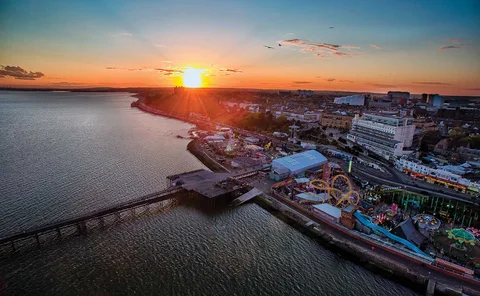

Clear buys book and assets of Maynard Milton Insurance Services

Clear Group has bought the book and assets of £4.9m gross written premium Southend-on-Sea based broker Maynard Milton Insurance Services.

Whistleblowing to FCA slips back

The Financial Conduct Authority received 253 reports from whistleblowers between April and June, down on the same period of last year and the first quarter of 2024.

SRG adds second acquisition to its MGA this year

Specialist Risk Group has agreed to buy Trilogy Underwriting, a specialist property and casualty managing general agent, to add to its MX underwriting pillar.

Acturis continues personal lines push with Covéa

Acturis has partnered with Covéa to make the insurer’s Home IHP product available on its platform, adding to the previously rolled out motor offering.

OneAdvent partners with Bridgehaven in capacity deal

OneAdvent has struck a deal with Bridghaven Specialty UK that will see the hybrid fronting insurer provide A-rated capacity to managing general agent Criterion to underwrite waste management and recycling risks.

Voyager Insurance Services sold to Caledon Group

Recently-formed investment group Caledon has bought travel and wedding insurance broker Voyager Insurance Services for an undisclosed sum.

Clarke starts at WTW as president of risk and broking

WTW has confirmed the arrival of Lucy Clarke as president of risk and broking, with Adam Garrard taking on the new role of chairman of risk and broking.

Bexhill UK partners with Acturis on premium finance

Bexhill UK and Acturis have partnered in a full API integration of Bexhill’s premium finance system and Acturis’s insurance broking system.

CII adds SEIB CEO Middleton to board

The Chartered Insurance Institute has appointed Suzy Middleton, CEO of SEIB Insurance Brokers, to engagement board member of personal finance, along with two other selections.

People Moves: 15 – 19 July 2024

Keep up to date with the latest insurance industry personnel moves.

Partners& snaps up two in employee wellbeing and healthcare push

Partners& has bought Nottingham-based Halo Consulting and Chester-based Personal Healthcare Management.