Ardonagh Group

The Ardonagh Group claims to be one of the world’s largest independent insurance distribution platforms and a top 20 global broker.

It has a combined workforce of over 10,000 people and a network spanning 200+ locations in more than 30 countries.

Across its portfolio, Ardonagh offers a diversified range of insurance-related products and services across the full insurance value chain globally. From complex multinational corporations to individuals purchasing personal insurance policies.

In the UK the Ardonagh Advisory platform includes Towergate which employs 2,000 people providing insurance products to small and medium sized enterprises (SMEs), corporate clients and specialist personal cover; and Bravo Networks which houses two of the largest networks of independent regional brokers in the UK: Broker Network and Compass.

The Ardonagh Group reported pro forma income for 2023 of $1.9bn (£1.45bn) and pro forma adjusted EBITDA of $695m, including completed and committed acquisitions to 20 March 2024. Ardonagh’s shareholders are Madison Dearborn Partners, LLC (MDP) and HPS Investment Partners (HPS).

Ardonagh expands into Greece

The Ardonagh Group has signed up to buy a majority stake in Athens-based SRS Group of Companies.

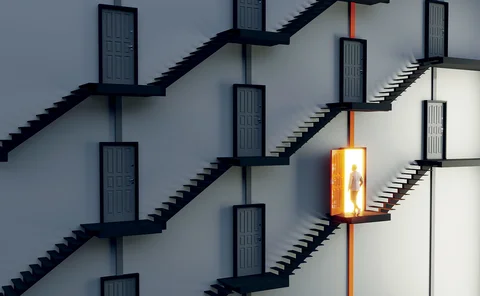

Succession planning: providing support to smooth the exit transition

Selling a broker can be an emotional experience, especially if the founder has run the business for a long time. Rachel Gordon looks at the options available for those with little M&A knowledge seeking an exit.

Markerstudy and Ardonagh Retail in merger talks

Markerstudy and Ardonagh's personal lines business are in talks over a deal, Insurance Age understands.

Succession planning: developing the senior manager talent of the future

Talent recruitment continues to be a major issue for brokers at all levels of seniority. With this in mind, Rachel Gordon looks at what insurers can do to help intermediaries develop their future leaders.

Ardonagh buys Stanhope Cooper and Renovation Underwriting

Ardonagh Advisory has signed up to buy a majority shareholding in high-net-worth broker Stanhope Cooper and MGA Renovation Underwriting.

Ardonagh Advisory announces first new deal of 2023 with Pace Ward buy

Ardonagh Advisory has announced its first new deal of the year with the purchase of Stoke-on-Trent based broker Pace Ward and revealed it has an “impressive pipeline of M&A”.

What does the More Than deal mean for the future of Ardonagh and RSA?

RSA and Ardonagh have their own distinct futures ahead. Ardonagh is a private equity-backed broker growing via consolidation, and RSA is intent on sharpening focus on its commercial broking relationships. The two have struck a deal on More Than's motor…

Swinton insurer panel ‘very excited’ to work with More Than motor customers – Ian Donaldson

Ardonagh Retail’s insurer panel is ‘very excited’ about working with More Than private motor customers on renewals, according to CEO Ian Donaldson.

Towergate targets £1.5bn after breaking through £1bn GWP barrier

Towergate achieved more than £1bn of gross written premium in 2022 for the first time ever and has set its sights on £1.5bn in just a few years, chief executive Richard Tuplin has revealed to Insurance Age.

RSA exits personal lines motor shifting renewals to Swinton

RSA has confirmed pulling out of the UK personal lines motor market, worth £120m in gross written premium, and signing up with Atlanta-owned Swinton on a renewals deal.

Ardonagh reports adjusted Ebidta growth of 22% to £389m

Ardonagh has increased its income by 30% to $1.5bn (£1.23bn), and adjusted Ebitda by 22% to $476m in its financial results for the 12 months ending 31 December 2022.

M&A slips back from 2021 record to £4bn in 2022

Imas has calculated that the value of UK general insurance distribution M&A dropped to £4bn in 2022 from £5.6bn in 2021, Insurance Age can reveal.

Bravo unveils ‘biggest transformation’ in broker network trading for two decades

Bravo has hailed its latest launch as “the biggest transformation” to how broker networks add value for members in the past 20 years.

Colm Tully to head up Paymentshield

Colm Tully has been appointed to lead Ardonagh-owned Paymentshield, succeeding Rob Evans.

Ex-Brokerbility boss Julie Rayson-Flynn joins Towergate

Towergate Insurance Brokers has appointed former Brokerbility director Julie Rayson-Flynn to the newly created role of national broking director.

Light on the horizon for brokers squeezed by rising professional indemnity costs

Brokers have faced rising professional indemnity costs amid a perfect storm of factors driving rate increases. But now the market is beginning to settle, although some firms will still face significant headwinds

People Moves: 16 - 20 January 2023

Keep up to date with the latest personnel moves within the insurance market.

Former Taoiseach Enda Kenny poised to join new Ardonagh International board

Ardonagh is planning to bring Enda Kenny, former Taoiseach in the Republic of Ireland from 2011 to 2017, into the company, a spokesperson has confirmed.

Wayne Tonge takes on major role within PIB Group

Wayne Tonge has taken on the managing director role at PIB-owned Barbon Insurance Group, Insurance Age can reveal.

Chambers and Newman reveals profit in Ardonagh sale year

Chambers and Newman has recorded a post-tax profit of £385,000 for the period including the sale to Ardonagh.

Blog: Keeping on with the Broker Diversity Push

In his opinion piece in October 2016, Insurance Age’s columnist Tony Cornell asked why do so few women get to the top in broking?

Broker Diversity Push – Q&A with Ardonagh’s CFO Diane Cougill

In an exclusive interview with Insurance Age as part of our Broker Diversity Push - Gender Leadership Gap campaign, Diane Cougill, chief financial officer at The Ardonagh Group shares her insights from a firm that while it has a rising percentage of…

UK broking M&A shrinking in 2022 as market becomes saturated

UK broking deals valued at £5m and above are set to reduce in 2022 as the number of available brokers for purchase shrinks.

Headline makers: December 2022

The key stories from the past month all in one place.