Personal

ERS widens appetite on car offering with digital expansion

Motor provider ERS has developed its digital offering and is set to add its manually-traded Prestige and Enthusiast products to its e-trade proposition as it seeks to make them more accessible to brokers.

Biba supports FCA travel insurance review delay as directory enquiries double

The British Insurance Brokers’ Association has backed the Financial Conduct Authority’s decision to delay a review into travel insurance signposting for medically vulnerable customers by a year.

Start-up digital broker Policy Powerhouse targets over £20m GWP within five years

Policy Powerhouse has launched a holiday let buildings and contents insurance product as CEO John Bibby set out the goals of the new digital broker.

Ageas adds Neil Mercier as head of standard motor

Neil Mercier has been appointed as head of standard motor at Ageas as it seeks to consolidate its position in the personal lines space.

FCA delays travel insurance signposting review

The Financial Conduct Authority has delayed its review into the implementation of travel insurance signposting rules by a year.

Brunel Group opens Newton Abbot office

Brunel Group has opened a branch in Newton Abbot, relocating staff from Bovey Tracey, and plans to double the size of the team in the new location.

Covéa returns to profit in 2021

Covéa Insurance has reported post-tax profit of £7.9m in 2021 reversing the loss of £30.8m the previous year.

Revenue spikes 14% at SEIB in 2021

SEIB Insurance Brokers has reported increases in revenue, operating profit and profit before tax for 2021.

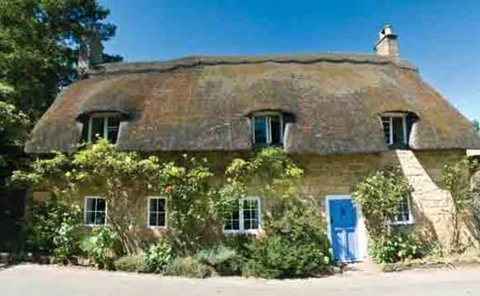

Lloyd & Whyte buys Naturesave Policies

Totnes-based Naturesave Policies, a broker with a focus on green and ethical insurance, has been acquired by Lloyd & Whyte for an undisclosed sum.

IFB reveals new ‘crash for cash’ hotspots across UK

The Insurance Fraud Bureau has detailed the top 10 new areas targeted by ‘crash for cash’ gangs as it warned drivers to be vigilant of the scam.

Somerset Bridge moves to Premium Credit

Broker Somerset Bridge has selected Premium Credit as its new, insurance premium finance provider in a multi-year deal.

Abacai motor brand Boom hits the market

Mark Wilson-led Abacai has rolled out motor insurance brand Boom.

LV adds Sam Dansey to lead home underwriting

LV has appointed Sam Dansey to head up its home underwriting team joining from Flood Re, Insurance Age can reveal.

Greenwood Moreland buys R C McLeish

Greenwood Moreland has bought R C McLeish Insurance Consultants in Lanark in its first deal since joining JMG Group.

UK buys on the horizon as Acrisure closes $725m funding round

US headquartered Acrisure has been valued at $23bn (£18.33bn) in its latest funding round.

Accredited deal sees QIC exit, Policy Expert confirms

Policy Expert’s capacity deal of up to £2bn over six years with Accredited Insurance will replace its existing arrangement with QIC Europe when the current contract expires, the business has confirmed to Insurance Age.

Disappointed FCA warns brokers on consumer harms

The Financial Conduct Authority has written to brokers warning there are significant risks of potential harm that both the market and individual firms need to address and that it will take action where needed.

Policy Expert signs six-year £2bn capacity deal with R&Q Accredited Europe

Home and motor insurtech Policy Expert has agreed a six-year capacity deal with A- rated R&Q subsidiary Accredited Insurance (Europe).

Blog: Commercial insurance fraud risk rises when data is taken at face value

As home and motor insurance providers employ ever more sophisticated tools to help identify application fraud and crack down on claims fraud, the risk is that the smaller end of the commercial insurance market could be next in line for a serious uptick…

Aviva enters exclusive discussions to buy Azur’s HNW operation

Aviva has opened exclusive negotiations with specialist managing general agent Azur Underwriting to buy its high net worth personal lines business in the UK and Ireland.

Income and Ebitda up at Ardonagh Advisory in Q1

Ardonagh Advisory has posted a surge in income for the first three months of 2022 to £95.5m.

Aviva grows UK GWP by 4% in Q1

Aviva has posted a 4% rise in UK gross written premiums for the first quarter of 2022 to £1.24bn but a deteriorating combined operating ratio of 99.4%.

Aviva halfway to regional underwriter recruitment target

Aviva has added a net 20 new underwriters to its underwriting team in the regions, chief distribution officer Gareth Hemming told Insurance Age.

Das LEI reports comprehensive £4.3m loss for 2021

Das Legal Expenses Insurance Company made an underwriting loss of £2.1m for the full year 2021 according to its solvency and financial condition report.