United Kingdom (UK)

Ageas ends DLG takeover plans after two rejections

After being rebuffed twice, Ageas has ended its pursuit of Direct Line Group, having valued the business at over £3.1bn.

Ecclesiastical grows UK & Ireland book but underwriting profit slips in 2023

Ecclesiastical Insurance upped its gross written premium in the UK and Ireland by 15.9% last year to £399.7m, but its combined operating ratio also rose to 92.1% from 87.1% in 2022.

People Moves: 18 – 22 March 2024

Stay in the loop with the latest personnel moves in insurance.

Brunel expands into East Anglia with Liability and General Insurance Brokers buy

Brunel Insurance Brokers has bought the renewal rights to Framlingham-based Liability & General Insurance Brokers.

Momentum profit soars 60% as revenue also leaps

Momentum Broker Solutions increased profit before tax by 60% to £1.8m last year as it grew revenue to £15.23m from £11.69m in 2022.

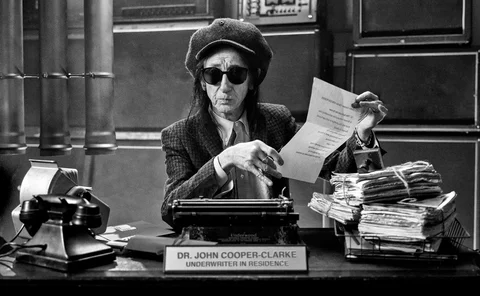

Hiscox teams up with poet Cooper Clarke as first ‘(under)writer in residence’

Hiscox has partnered with punk poet Dr John Cooper Clarke, naming him its first ‘(under)writer in residence’ as part of a new campaign.

Clear grows Ebitda by a third

Clear Group grew its Ebitda by 33.4% to £19m, with revenue jumping to £74.7m in the year ended 31 October 2023.

Takeover target Direct Line posts £189m operating loss

Direct Line Group has revealed a £189.5m loss from ongoing operations as the sale of NIG pushed the insurer into profit for 2023.

Close Brothers posts more than £1bn premium finance book

Close Brothers Group has reported “record” first half levels in its premium finance book of £1.04bn for the six months to 31 January 2024.

Kingfisher opens broking HQ in West Midlands

Kingfisher Insurance has opened its national broking headquarters in Rubery, Birmingham, housing its motor trade, commercial, and non-standard home insurance teams.

Biba appoints Julie Comer as head of compliance

The British Insurance Brokers’ Association has recruited Julie Comer from Lloyd & Whyte as head of compliance.

Sabre to ride on in motorcycle with broker deals after MCE collapse

Sabre is in discussions with larger motorcycle brokers and confident of adding two new partners towards the end of 2024 and into next year, CEO Geoff Carter told Insurance Age.

FCA to raise budget by 10.7%

The Financial Conduct Authority has set its annual funding requirement for 2024/25 at £755m, an increase of 10.7%.

Sabre posts record GWP as profits bounce back in 2023

Motor specialist Sabre grew gross written premiums by 31% to £225.1m last year and improved its combined operating ratio to 86.3% from 93.4%.

Broker worries bubbling up on Ageas-Direct Line but one hope trumps all

Brokers have raised concerns about the impact on the sector if Ageas snaps up Direct Line but expressed confidence in the potential buyer’s management should a deal come to pass.

Swigciski swaps Das for leadership role at HSB

HSB has recruited David Swigciski from Das as managing director of Premier Guarantee succeeding Jacki Goodman who retired at the end of 2023.

Taylor outlines plan to grow Aviva strategic accounts

Michelle Taylor, Aviva strategic accounts director, aims to be responsive and visible for brokers and sees opportunities after the insurer signed up to buy Probitas.

Insurance leaders stay optimistic on growth, says KPMG

Insurance leaders remain optimistic about growth but trail banking and asset and wealth management bosses who are even more upbeat, according to a survey by KMPG UK.

Meet the MGA: Ventis

With a ‘breath of fresh air’ Latin-inspired name, CEO Gareth Roberts, pictured second right, explains why Ventis’ USPs of rapid service and sector expertise are helping it gain traction in the real estate market.

Trade Credit Insurance is again in the spotlight. How can brokers take advantage?

Described as a ‘sleeping giant’ of the insurance market, brokers should wise up to the opportunities offered by trade credit. Especially, as Martin Friel discovers, recent geo-political events mean this vital safety for businesses is edging to toward the…

People Moves: 11 – 15 March 2024

Follow the latest insurance personnel moves.

Fair value not a Trojan Horse for price regulation, says FCA boss Nikhil Rathi

The onus on firms to satisfy themselves about fair value under the Consumer Duty is “not a Trojan horse for price regulation”, according to Nikhil Rathi, CEO of the Financial Conduct Authority.

Axa launches schemes directory

Axa Commercial has launched an online directory to help brokers navigate the niche schemes market.

PSC confirms takeover talks as consolidators tipped to swoop

Australia-headquartered PSC Insurance, a Top 100 broker in the UK, has confirmed being approached by multiple parties and in talks regarding a possible buyout.