Motor

SRG drives into motorsport with Allianz hire

Specialist Risk Group’s managing general agent, MX, is on the starting grid for the launch of a specialist motorsport underwriting offering, and has added a new leader.

Four insurers able to restart selling GAP insurance – FCA

The Financial Conduct Authority has confirmed that four insurers can restart selling guaranteed asset protection insurance after it took action in February and March to halt sales across the market.

Broker scepticism on capacity in commercial motor eases but still high at 76%

A survey by Direct Commercial has found 76% of brokers expressing scepticism about the availability of specialists or insurers offering capacity for the haulage, waste disposal and courier markets, down from 83% six months ago.

Oxbow Partners forecasts motor market COR of 94% in 2024

Oxbow Partners has predicted the UK motor market will return to profit this year with a combined operating ratio of 94% versus a 102% rate in 2023.

Wallace: QBE reaping benefits of focus on ‘holy grail of service’

QBE’s consistency and lack of upheaval in contrast to some of its peers has helped it become a “viable alternative” for regional brokers.

Biba 2024: Aviva not afraid of ‘tough’ conversations, but ‘categorially’ committed to broker PL, says MD Morris

Aviva has reiterated its commitment to brokered personal lines business, although it is not opposed to a bit of ‘tough’ love to maintain a consistent approach to the market.

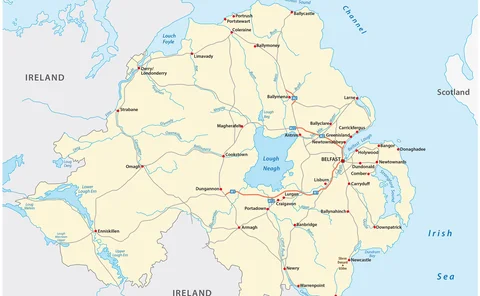

Are Northern Ireland brokers feeling the personal lines capacity squeeze more than most?

With prices rising faster in personal motor and household than other parts of the UK, brokers in Northern Ireland have good reason to be worried about remaining competitive. Siân Barton gets to the root of the issue and explores what is being done to…

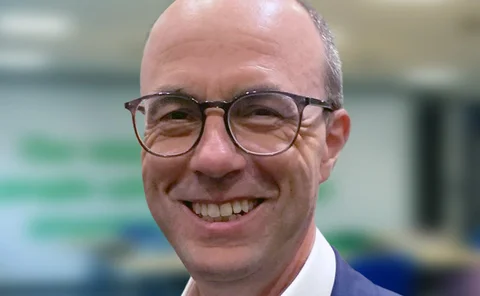

Transparency, team and targets – Zurich boss David Nichols ready to meet and greet brokers at Biba

One year on from his first British Insurance Brokers’ Association conference in the Zurich hotseat, UK head of retail David Nichols shares his key messages for brokers ahead of the upcoming event in Manchester.

Arc Legal founder Finan launches Addept Group after buying broker Policywise

Arc Legal Assistance co-founder Richard Finan has returned to the insurance market with a new wholesale business Addept Group, having acquired broker Policywise.

EY predicts three years of slowing premium income growth for insurers

EY has forecast UK non-life insurance premium income growth will slow to 7% in 2024, from 8.7% in 2023, dropping again to 5.1% in 2025 and 3.8% in 2026.

Flock partners with Acorn on taxi fleet insurance product

Insurtech Flock has partnered with the Acorn Group to launch a taxi fleet insurance product in an aim to make the world “quantifiably safer” by helping customers reduce risk, CEO of Flock, Ed Leon Klinger told Insurance Age.

MIB appoints Angus Eaton as CEO

The Motor Insurers’ Bureau has named Angus Eaton from Hastings Group as its new CEO, taking over from Dominic Clayden in July.

Rebrand of LV Broker to Allianz goes live

Allianz has completed the rebrand of personal lines insurer LV Broker and revealed the appointment of Carolyn Rich to the newly created post of director of brand.

Motor still in spotlight as FOS confirms half-year GI complaints rise

The Financial Ombudsman Service has again flagged car and motorcycle insurance complaints as it calculated an 18% rise in general insurance cases.

Aviva’s David Martin on the art of the possible

After making a “substantive step change”, Aviva knows there is more to do, and will be meeting with brokers at the British Insurance Brokers’ Association’s conference to work together on what comes next, according to managing director of UKGI…

Wakam receives PRA approval for new £500m GWP UK insurer

French insurance group Wakam has told brokers thinking of setting up their own managing general agents to consider it as a capacity partner after receiving regulatory approval for a new UK subsidiary.

Motor premiums increase by just 1% in Q1 – ABI

Motor premiums rose by just 1% in the first quarter of 2024, however the average claim paid increased by 8% according to the Association of British Insurers.

Interview: Simon McGinn on Dual’s regional ground-up build for brokers

In his first interview since taking up the role, Dual UK CEO Simon McGinn tells Insurance Age about his plans for the managing general agent, including expanding the reach with regional brokers and boosting the digital offering.

The growing role for brokers in fighting insurance fraud

With reports of fraud escalating in terms of value or number, the role of brokers in combatting these crimes should not be underestimated. Edward Murray looks at the controls, validation tools and processes being implemented to support both detection and…

ABI stops short on voluntary premium finance cap as it sets out five principles

The Association of British Insurers has stopped short on a voluntary industry-led cap on premium finance as it set out five principles aimed at helping consumers manage the cost of paying-monthly for motor insurance.

AA’s insurance arm Ebitda jumps by 42%

The AA’s insurance arm’s adjusted Ebitda rose by 42% to £64m as its broker books fell slightly in the year ended 31 January 2024.

Zurich strikes five-year capacity deal with MGA Freedom Services

Zurich has signed a five-year capacity deal with MGA Freedom Services that will see both re-enter the telematics market, Insurance Age can reveal.

Biba Conference 2024 countdown: LexisNexis’s Dan Cicchetti

Dan Cicchetti, senior director of client engagement in the UK and Ireland at LexisNexis Risk Solutions, looks forward to showcasing vehicle data solutions on its stand, before heading to Box Bar Manchester for another of its legendary client evenings.

First fall in car premiums for over two years

Comprehensive car insurance premiums fell by 5% in the first three months of 2024 after nine consecutive quarters of rises, according to the latest research from Confused/WTW.