Claims

FSCS details £23m MCE Insurance Company recovery from £90m hit

The Financial Services Compensation Scheme has secured £23m from the estate of Gibraltar-based Green Realisations 123, formerly known as MCE Insurance Company, after paying out approximately £90m in compensation to the firm’s customers.

TV and films in focus as Spotlite Claims launches EL and PL support

Spotlite Claims, the specialist loss adjusting arm of Woodgate and Clark, has launched employers’ liability and public liability claims support due to increasing demand from brokers and insurers working with the global film and TV industries.

McLarens joins Biba as associate

The British Insurance Brokers’ Association has added McLarens loss adjusters as an associate.

Admiral completes RSA direct home and pet insurance deal

Admiral Group has completed the purchase of RSA direct home and pet insurance renewal rights for £82.5m.

Chubb rolls out new practice targeting healthtech sector

Chubb has launched a new healthtech industry practice in the UK.

FCA warns insurers, again, on undervaluing total loss motor claims

The Financial Conduct Authority has confirmed finding evidence that suggests motor insurers are offering customers less than the full value of written-off or stolen vehicles and, in some cases, only increasing offers when a customer complains.

Ecclesiastical grows UK & Ireland book but underwriting profit slips in 2023

Ecclesiastical Insurance upped its gross written premium in the UK and Ireland by 15.9% last year to £399.7m, but its combined operating ratio also rose to 92.1% from 87.1% in 2022.

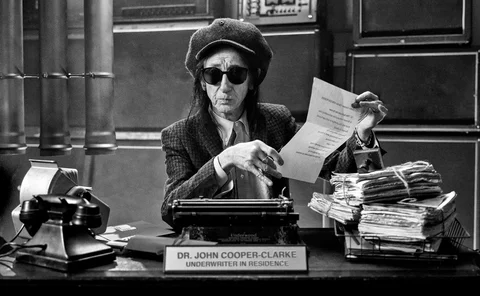

Hiscox teams up with poet Cooper Clarke as first ‘(under)writer in residence’

Hiscox has partnered with punk poet Dr John Cooper Clarke, naming him its first ‘(under)writer in residence’ as part of a new campaign.

FCA to raise budget by 10.7%

The Financial Conduct Authority has set its annual funding requirement for 2024/25 at £755m, an increase of 10.7%.

Meet the MGA: Ventis

With a ‘breath of fresh air’ Latin-inspired name, CEO Gareth Roberts, pictured second right, explains why Ventis’ USPs of rapid service and sector expertise are helping it gain traction in the real estate market.

Trade Credit Insurance is again in the spotlight. How can brokers take advantage?

Described as a ‘sleeping giant’ of the insurance market, brokers should wise up to the opportunities offered by trade credit. Especially, as Martin Friel discovers, recent geo-political events mean this vital safety for businesses is edging to toward the…

Broker’s emails defeat negligence claim

Key to the broker’s success in defending all allegations of negligence in a recent High Court case was the ability to rely on contemporaneous emails as evidence of its advice given nearly a decade before the trial, Marcus Campbell, partner at DAC…

Zurich uncovered £78.5m in bogus claims in 2023

Zurich UK faced down £78.5m in fraudulent claims last year, equating to £215,117 a day.

Blog: Why building safety case reports can be the gold dust for everyone

The evolution of construction techniques and material mean it is more important than ever that brokers don’t lose sight of the need for comprehensive building information. Julian Strutt, director of estate adjusting at Charles Taylor explains.

Admiral chair: Defending UK motor advantage remains ‘number one priority’

Admiral is not going to give up its crown as the UK’s leading personal lines insurer to Markerstudy without a fight, its chair has intimated.

Meet the MGA: Generis

A focus on expertise, human touch and a future-proofed portfolio have been key to the first five years of success at Generis. Managing director Andy Francis explains the importance of a hard-won reputation and making sure staff come to work with smiles…

Home insurance prices jump 40% in a year

The average quoted price of home insurance increased by 40.6% in the 12 months to January – the highest annual increase since Consumer Intelligence began tracking prices in 2014.

Start-up fleet broker aims for 90% app uptake

Start-up fleet broking specialist Hummingbird Insurance Services is aiming to create a sustainable motor portfolio that runs at an industry-leading loss ratio.

Motor insurance complaints to FOS climb again

Motor insurance has remained in the top five most-complained-about products with buildings insurance also joining the list, according to the Financial Ombudsman Service as it released data for October to December last year.

News analysis: What next for the motorbike market after Axa’s withdrawal?

Axa’s withdrawal from the motorbike market next month has again raised questions about a potential capacity crunch for those brokers insuring two-wheelers. Saxon East explores what effect this and other trends are having on the sector.

Experts tackle factors driving claims complaints to five-year high

The industry needs to make it clear to consumers why premiums are rising according to specialists at the Association of British Insurers’ annual conference.

Start-up broker partners with Agile on fleet claims app

Agile Developments Group has partnered with brokerage Hummingbird Insurance Services to deliver the Agile claim app, portal and dashboard tailored to meet the needs of its fleet clients.

Allianz creates financial lines claims team in D&O and PI push with brokers

Allianz has created an in-house financial lines claims team covering mid-corp and SME firms, focusing on directors & officers and professional indemnity business.

In Depth: Businesses falling into the justice gap

Widely seen as a personal problem, diminishing access to justice also severely impacts businesses. Tony Buss, managing director at ARAG explains how the justice gap has become a major issue for companies in the UK and what brokers can do to help.